Portfolio

Management

Unlock your financial success with KSEMA's expert

portfolio management

portfolio management

Mutual Fund

Distribution

Experience financial excellence with our bespoke custom

packages, tailored to suit your unique needs.

packages, tailored to suit your unique needs.

Advisory Services

& Consultation

Navigate confidently towards your financial goals with

tailored advisory and consultation services

tailored advisory and consultation services

Streamlined & Efficient Wealth Management Solutions. Get more help

About KSEMA

Ksema Wealth Private Ltd was incorporated in 2010 to provide Investment Services for its exclusive clientele from India, Middle East and South East Asia. Promoted by Professionals whose combined experience exceeds 90 man-years in the field of Investments in multi asset classes that include direct equity, fixed income, bonds, real estate and structured products. KSEMA is well capitalized beyond the regulatory requirement of Rs 50 million ( approx. USD 602K).

Trusted by

clients

O Léon casino destaca-se como o principal destino para jogar slots online em Portugal, oferecendo uma ampla variedade de jogos emocionantes e promoções atrativas para os jogadores.

Why KSEMA

Experience

Investment Committee members and Fund Managers have combined experience of more than 90 man-years in local and international financial markets.

Experience

Investment Committee members and Fund Managers have combined experience of more than 90 man-years in local and international financial markets.

Research & Operations

- Young and enthusiastic Research analysts bringing new ideas to the desk.

- Advanced financial modeling techniques to forecast enhances the conviction.

- Strong operational network of custody/broker/banker enhances the efficiency of back office and client reporting

- Advanced financial modeling techniques to forecast enhances the conviction.

- Strong operational network of custody/broker/banker enhances the efficiency of back office and client reporting

Research & Operations

- Young and enthusiastic Research analysts bringing new ideas to the desk.

- Advanced financial modeling techniques to forecast enhances the conviction.

- Strong operational network of custody/broker/banker enhances the efficiency of back office and client reporting

- Advanced financial modeling techniques to forecast enhances the conviction.

- Strong operational network of custody/broker/banker enhances the efficiency of back office and client reporting

Performance

- Lipper award winning fund manager.

- Client centric investment strategy pushes the performance.

- Client centric investment strategy pushes the performance.

Performance

- Lipper award winning fund manager.

- Client centric investment strategy pushes the performance.

- Client centric investment strategy pushes the performance.

Client

- Quarterly clientele interactions

- Two-way communication with the clients keeps the portfolio’s investment objective in check, which in turn builds the trust with the clients.

- Two-way communication with the clients keeps the portfolio’s investment objective in check, which in turn builds the trust with the clients.

Client

- Quarterly clientele interactions

- Two-way communication with the clients keeps the portfolio’s investment objective in check, which in turn builds the trust with the clients.

- Two-way communication with the clients keeps the portfolio’s investment objective in check, which in turn builds the trust with the clients.

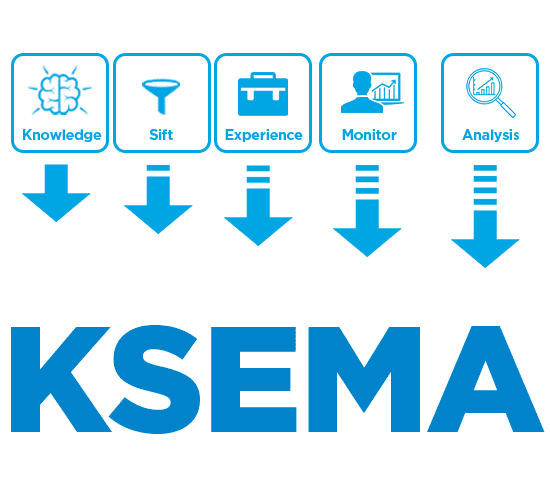

Our Process

Input

Portfolio

Portfolio

KSEMA

Portfolio Themes

fees and charges

Our Value Proposition

Management Fees

A fee of 1.5% per annum is charged on the portfolio on a quarterly basis calculated on daily closing balance of the portfolio.

Performance Fees

A Performance fee of 10% of profits exceeding the hurdle rate of 10%. High Water mark applicable.

Other operational expenses*

Custody& Demat Charges- Actual : 3bps

Brokerage : 0.1% on all trades

Transaction/Bank/Taxation-Actuals

Exit Fees:2% (less than 1 year):1% (1-2 years)

* Any revision from service providers will be intimated and applied in future if any.

* Any revision from service providers will be intimated and applied in future if any.

Our Network

KSEMA Wealth Pvt Ltd.

The Hive - VR Chennai, 3rd Floor, Jawaharlal Nehru Road, Thirumangalam, Anna Nagar, Chennai-600040, Tamil Nadu, India

KSEMA

Want to Maximize Your Wealth?

KSEMA is a SEBI Registered PMS FIRM

Number of Complaints

| Type of Client | Total No. of complaints | |||

|---|---|---|---|---|

| Pending at the beginning of the month | Received during the month | Resolved during the month | Pending at the end of the month | |

| Domestic - PF/ EPFO | 0 | 0 | 0 | 0 |

| Domestic Corporates | 0 | 0 | 0 | 0 |

| Domestic Non-Corporates | 0 | 0 | 0 | 0 |

| Foreign - NR | 0 | 0 | 0 | 0 |

| Foreign - FPI | 0 | 0 | 0 | 0 |

| Foreign - Corporates | 0 | 0 | 0 | 0 |

| Foreign - Others | 0 | 0 | 0 | 0 |

| Total | 0 | 0 | 0 | 0 |

Note: Data on investor complaints registered through SCORES or which are directly received by Portfolio Manager to be provided