KSEMA - Alpha

Theme Description

The fund seeks long-term capital appreciation by investing substantially in the equity of companies that are leaders in their industries/segment of industries, and which the managers believe are suitable for a buy-and-hold strategy.

Theme Policy

Growth

Quality

Valuation

KSEMA Alpha - Top Holdings (May-25)

| COMPANY | HOLDINGS (%) |

| ICICI Bank Ltd | 7.73% |

| Hindustan Aeronautics Ltd | 6.87% |

| State Bank Of India | 5.82% |

| Mahindra & Mahindra Ltd | 5.55% |

| HDFC Bank Ltd | 5.51% |

| Reliance Industries Ltd | 5.41% |

| Larsen & Toubro Ltd | 5.07% |

| Canara Bank | 4.69% |

| Infosys Ltd | 4.20% |

| Axis Bank Ltd | 4.02% |

| Bharat Electronics Ltd | 3.85% |

| Tata Consultancy Services Ltd | 3.61% |

| NITIN SPINNERS LIMITED | 3.32% |

| HCL Technologies Ltd | 2.80% |

| Adani Ports And Special Economic Zone Ltd | 2.79% |

| Sun Pharmaceutical Industries Ltd | 2.56% |

| Bharat Dynamics Ltd | 2.25% |

| Tata Motors Ltd | 2.25% |

| Idfc First Bank Ltd | 2.10% |

| Housing And Urban Development Corporation Ltd | 1.82% |

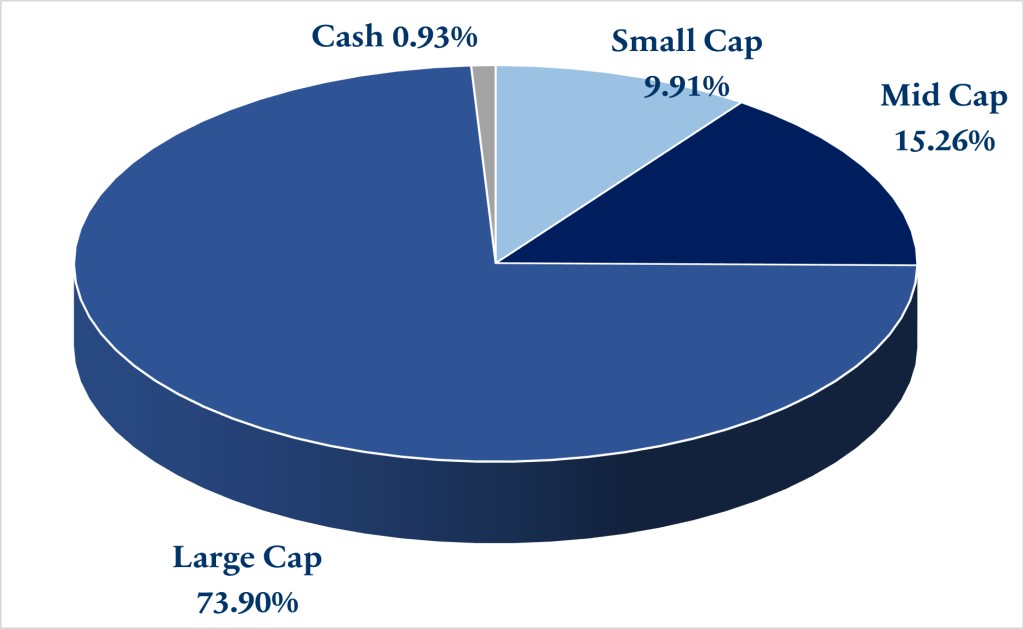

KSEMA Alpha - Market Cap Allocation

(May-25)

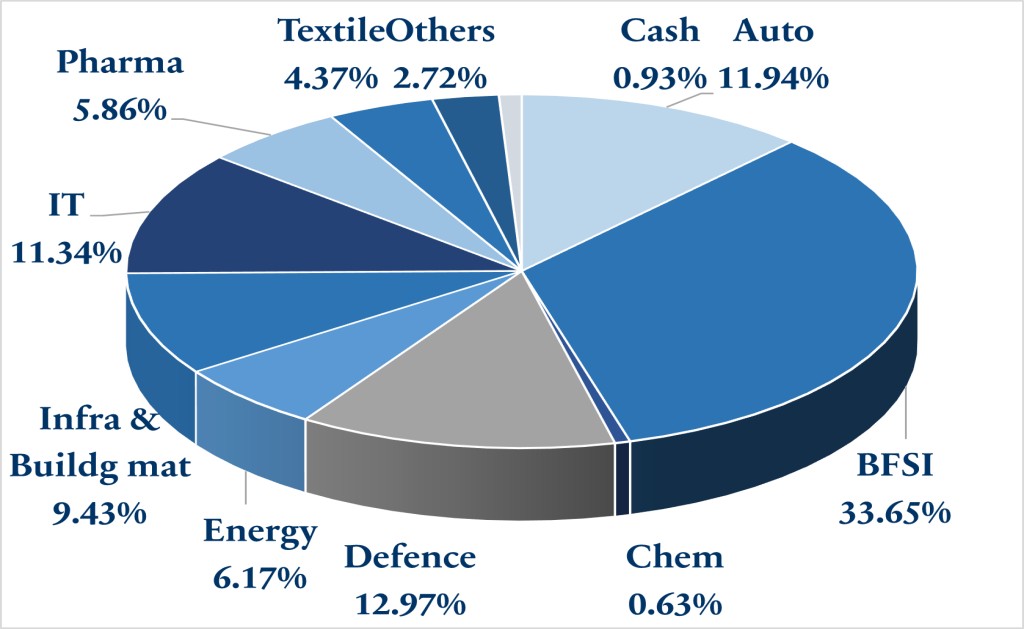

KSEMA Alpha - Sector-wise Holdings

(May-25)

Performance - Statistical Analysis (End of May-2025)

KSEMA India Opportunities (Post Exp)

| Since Jan 2019 | ALPHA | NIFTY50TRI |

| Average Monthly Return | 1.5% | 1.3% |

| Monthly Maximum Loss | -24.7% | -23.0% |

| Month of Maximum Loss | Mar-20 | Mar-20 |

| Annualized Return | 17.9% | 15.3% |

| Annualized Volatility | 19.5% | 17.6% |

| % of Winning Months (Against Benchmark) | 57.9% | na |

| % of Gained Months | 64.5% | 63.2% |

| YTD | 11.6% | 5.5% |

| Sharpe (RF 6.8%) | 0.58 | 0.50 |

| Alpha | 3.9% | na |

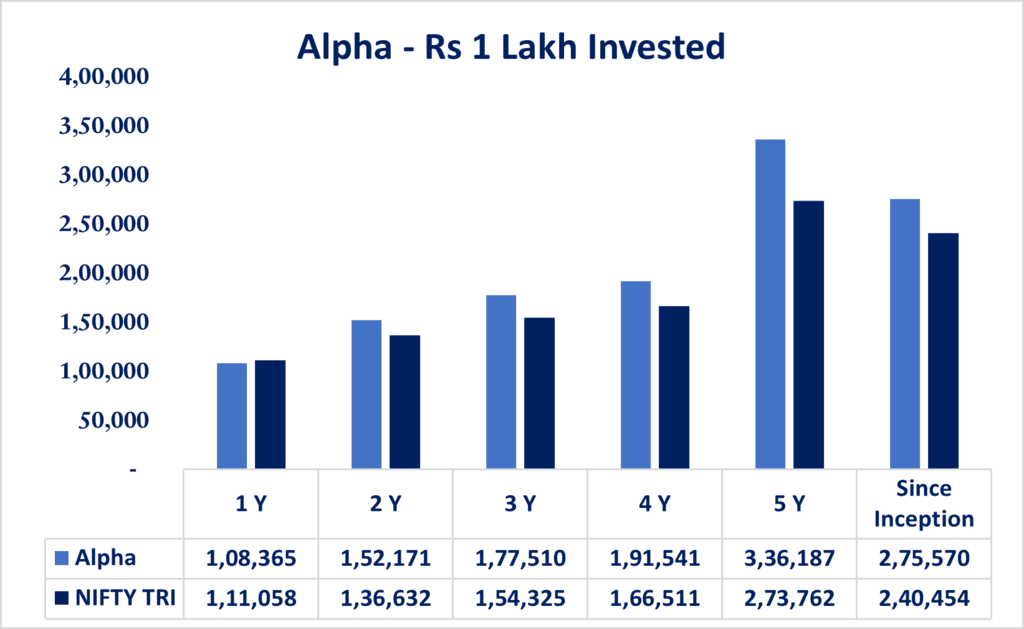

Performance Analysis (End of May-25)

Rs 1 Lac Invested Would Be Worth (Post Exp)

Alpha

Performance Analysis (End of May-25)

Period Wise

Alpha - India Opportunities

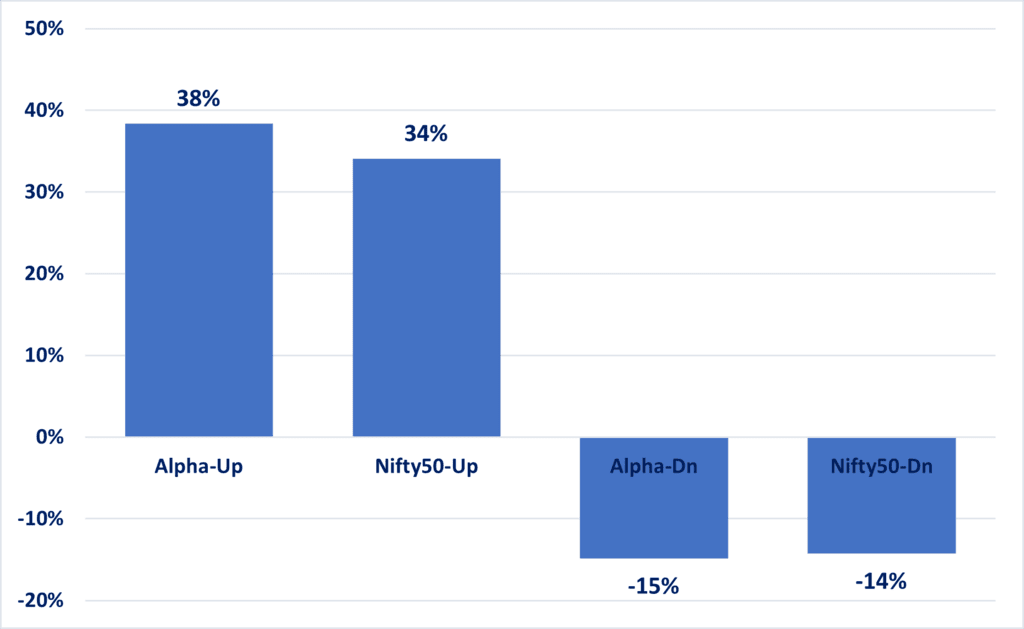

Capture Ratio (End of May-25)

Market Trends

Alpha - Up Vs Dn

Disclaimer

This presentation is for information purposes only and is not an offer to sell or a solicitation to buy any Securities. The views expressed herein are based on the basis of internal data, publicly available information & other sources believed to be reliable. Any calculations made are approximations meant as guidelines only, which need to be confirmed before relying on them. These views alone are not sufficient and should not be used for the development or implementation of an investment strategy. It should not be construed as investment advice to any party. All opinions and estimates included here constitute our view as of this date and are subject to change without notice. Neither Ksema Wealth Private Limited, nor any person connected with it, accepts any liability arising from the use of this information. The recipient of this material should rely on their investigations and take their own professional advice