Tamil Nadu, Chennai - 600040

info@ksemawealth.com

The fund seeks superior returns over long term by investing in high growth-oriented stocks that are sector agnostic.

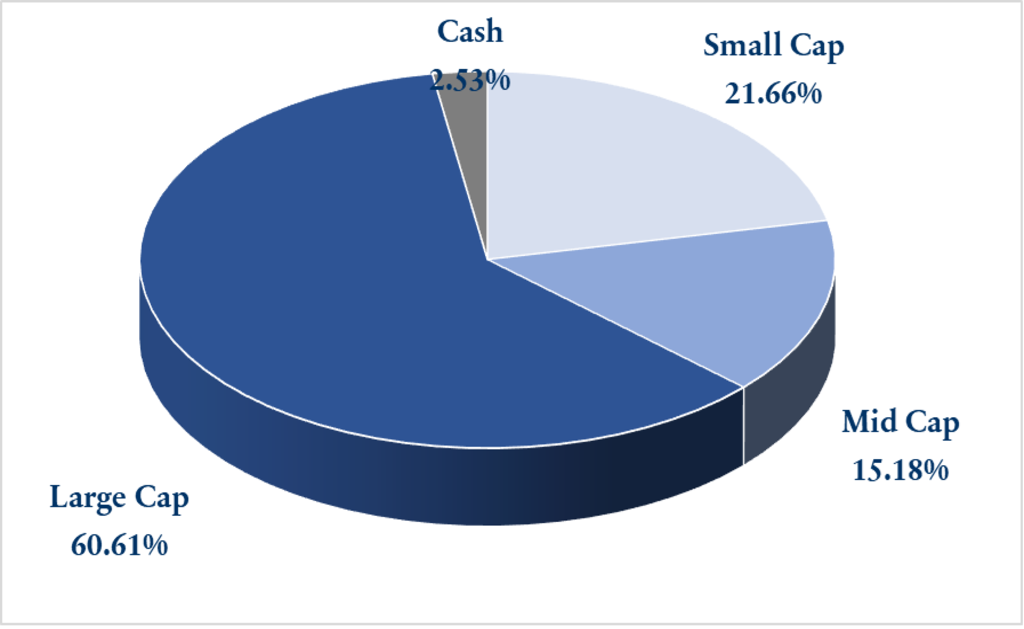

The Fund will invest upto 50% in Large cap,upto 40% in Mid-cap company shares and up to 10% for special situation opportunities. The Fund maintains a concentrated, high conviction portfolio consisting of companies which are believed to be undervalued relative to their growth prospects. The Fund will typically invest in the shares of fewer than 45 companies. The Nifty 500 Index is a point of reference against which the performance of the Fund may be measured.

Portfolio Construction of the core segment will be driven by fundamental, bottom-up research

on established multicap companies that meet our criteria of:

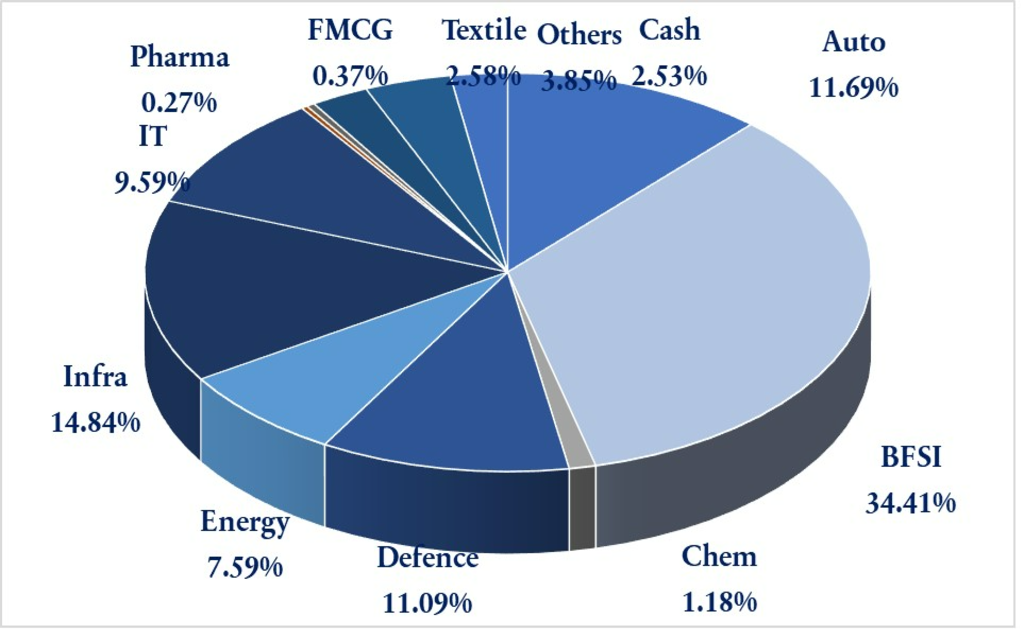

| COMPANY | HOLDINGS (%) |

| ICICI Bank Ltd | 6.78% |

| State Bank Of India | 6.04% |

| Reliance Industries Ltd | 5.14% |

| HDFC Bank Ltd | 5.10% |

| Canara Bank | 4.44% |

| Larsen and Toubro Ltd | 4.12% |

| Bharat Electronics Ltd | 4.08% |

| Hindustan Aeronautics Ltd | 3.74% |

| Infosys Ltd | 3.73% |

| Axis Bank Ltd | 3.39% |

| Tata Consultancy Services Ltd | 3.34% |

| Idfc First Bank Ltd | 2.73% |

| Mahindra AND Mahindra Ltd | 2.59% |

| Bharat Dynamics Ltd | 2.41% |

| Adani Ports And Special Economic Zone Ltd | 2.40% |

| Hero Motocorp Ltd | 2.31% |

| Tata Power Co. Ltd | 2.28% |

| NITIN SPINNERS LIMITED | 2.28% |

| Bharat Forge Ltd | 2.10% |

| WAAREE ENERGIES LIMITED | 1.90% |

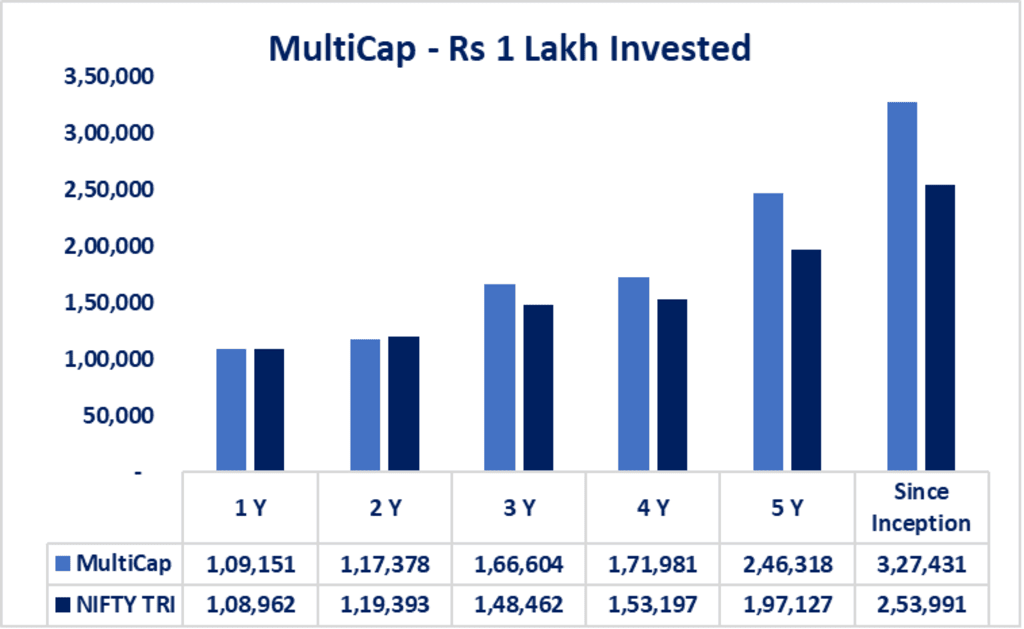

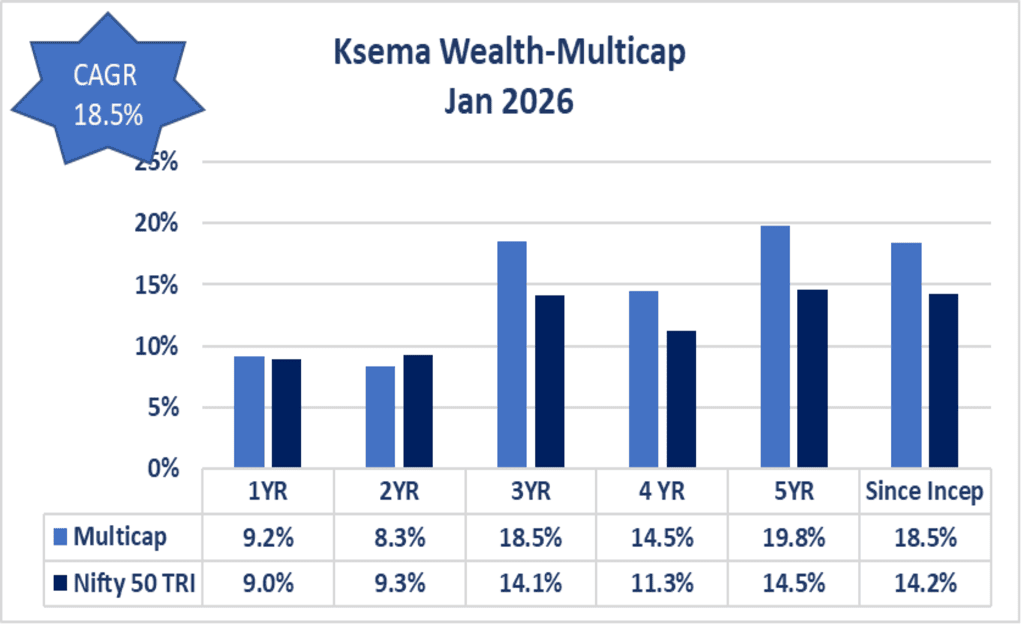

| Since Jan 2019 | MULTICAP | NIFTY50TRI |

| Average Monthly Return | 1.6% | 1.2% |

| Monthly Maximum Loss | -29.9% | -23.0% |

| Month of Maximum Loss | Mar-20 | Mar-20 |

| Annualized Return | 18.5% | 14.2% |

| Annualized Volatility | 21.0% | 17.0% |

| % of Winning Months (Against Benchmark) | 57.1% | na |

| % of Gained Months | 65.5% | 61.9% |

| YTD | 13.1% | 8.8% |

| Sharpe (RF 6.5%) | 0.57 | 0.46 |

| Alpha | 6.3% | na |

MultiCap

MultiCap - India Opportunities

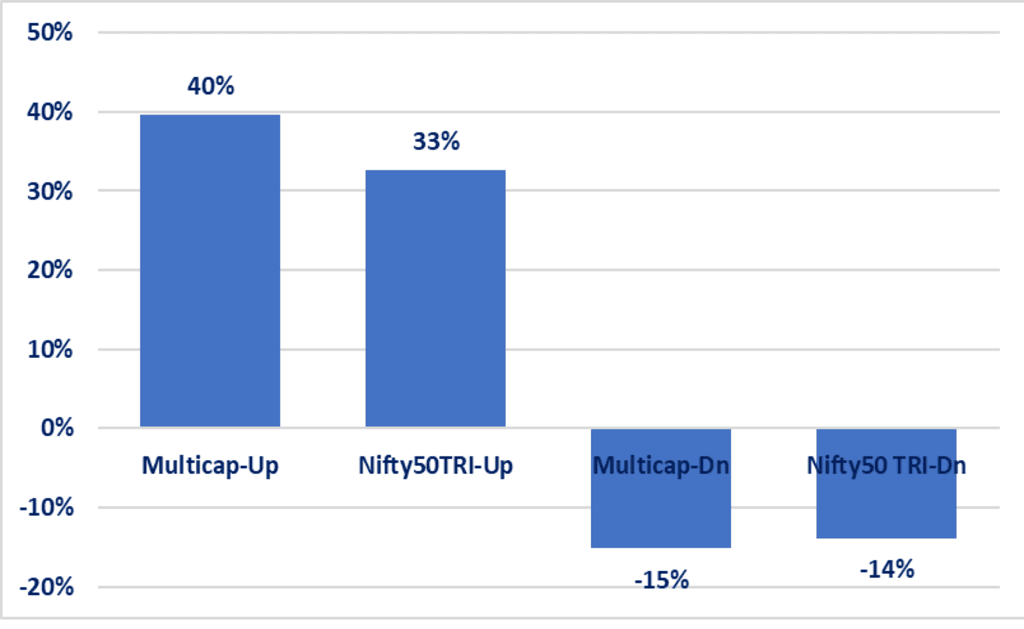

MultiCap - Up Vs Dn

This presentation is for information purposes only and is not an offer to sell or a solicitation to buy any Securities. The views expressed herein are based on the basis of internal data, publicly available information & other sources believed to be reliable. Any calculations made are approximations meant as guidelines only, which need to be confirmed before relying on them. These views alone are not sufficient and should not be used for the development or implementation of an investment strategy. It should not be construed as investment advice to any party. All opinions and estimates included here constitute our view as of this date and are subject to change without notice. Neither Ksema Wealth Private Limited, nor any person connected with it, accepts any liability arising from the use of this information. The recipient of this material should rely on their investigations and take their own professional advice